Finance

Jan 29, 2026

Learn how JPMorgan Chase makes money, from consumer banking and credit cards to investment banking and asset management in its diversified revenue model. Photo by: J.P. Morgan

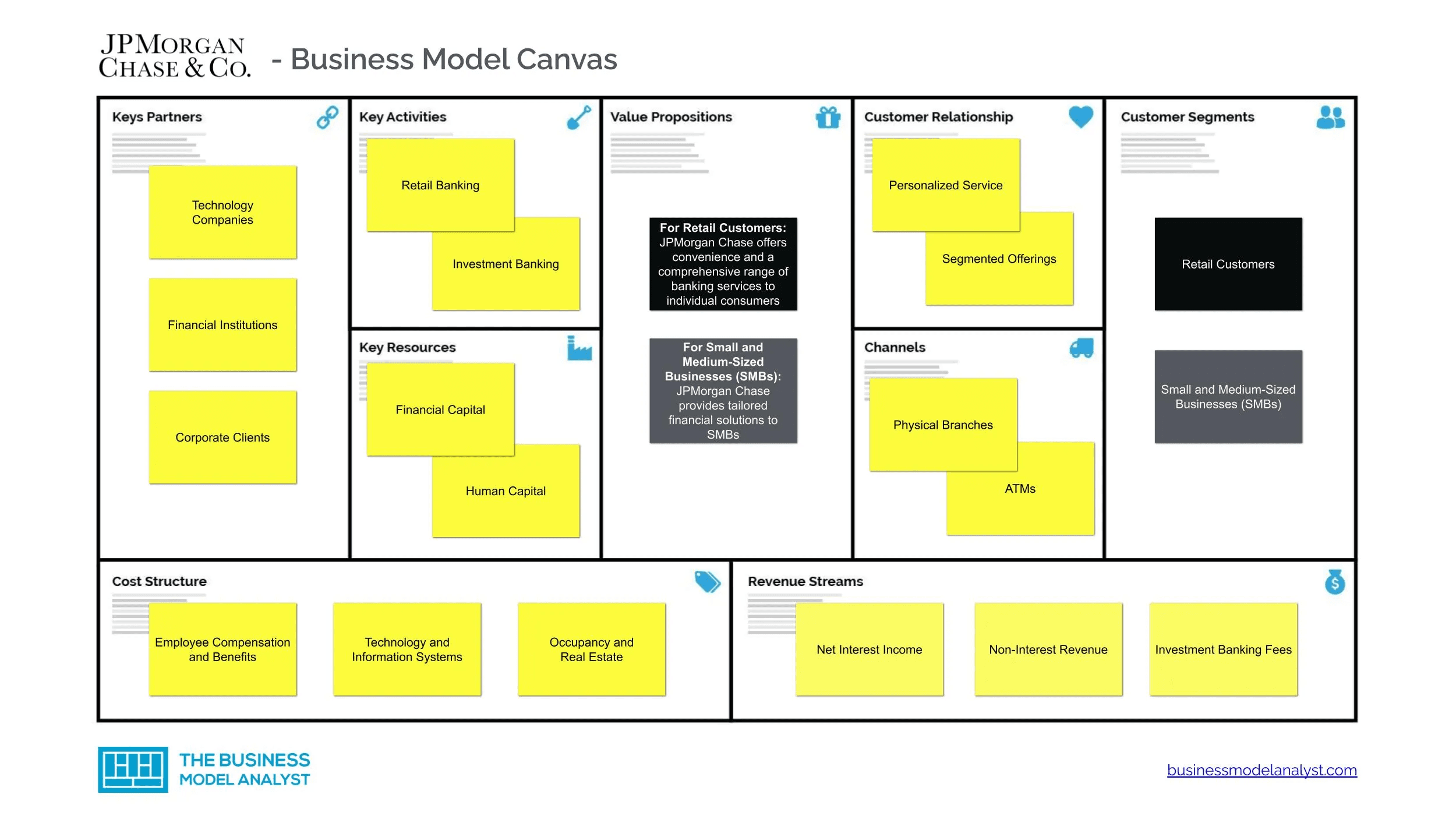

JPMorgan Chase is the biggest bank in the U.S., and its profits come from different places.

It makes money from things like regular checking accounts all the way to big investment deals around the world, making it one of the most varied income streams in the finance world.

Unlike many new finance companies that focus on one thing, JPMorgan Chase makes money in many ways.

It gets income from regular people, small companies, big global businesses, governments, and investors.

Having such a variety helps keep its earnings steady, even when the economy changes, and is a big reason why it stays ahead.

JPMorgan Chase divides its work into different business areas. Each one plays a unique role in the company's income, the risks it takes, and how it grows over time.

For many people in the U.S., JPMorgan Chase is best known for its consumer banking services. This includes things like checking and savings accounts, credit cards, car loans, mortgages, and banking for small businesses.

Here's how they make their money:

Net interest income: It’s basically the difference between what they earn on loans and what they pay out on deposits.

Credit card fees and interest: This is a big moneymaker, especially when the economy is strong and people are spending a lot.

Service fees: These are fees for things like keeping your account active, overdrafts, and other transactions.

JPMorgan's huge number of deposits helps this part of the business because it gives them a cheap source of funds. Even though interest rates can change and affect profits, consumer banking brings in a reliable stream of income because of its large scale.

This part of the group works with big companies, investors, and governments all over the world. You usually see them doing their thing when big things happen in the economy.

Here's how they make money:

Investment banking fees: They give advice on things like mergers, buying other companies, IPOs, and offering debt.

Markets & trading: They make money from trading stocks, bonds, currencies, and commodities.

Treasury services: They help global firms with managing their cash, payments, and keeping things liquid.

The results here can change more than in consumer banking. But when the market is doing a lot, investment banking can make a lot of money and make JPMorgan stronger worldwide.

JPMorgan Chase handles finances for big institutions, wealthy individuals, retirement plans, and regular investors.

Here's how this part of the business makes money:

Management fees: They take a cut of the total assets they manage for you.

Advisory fees: They charge for offering financial plans and investment advice.

Performance-based income: In some cases, when it's agreed upon, they earn money based on how well your investments do.

This business does well when the market grows over time and clients stick around. Since more people in the U.S. are investing for retirement, managing assets and wealth is generally seen as a reliable way to make money in the long run.

Commercial banks bridge the gap between personal and business finance. They offer services to medium-sized companies, charities, and local governments.

They make money through:

Business loans and credit lines

Commercial property loans

Treasury and payment solutions

This area helps build strong customer relationships that can lead to investment banking or asset management deals, boosting the overall value of each customer over time.

Technology is becoming more and more important to how JPMorgan makes money, even though it's not a separate part of their financial reports. The bank puts billions of dollars into things like online platforms, security, and payment systems each year.

These investments help to:

Make things run smoother and cut costs

Handle lots of payments

Offer online banking that keeps younger clients happy

It takes time to see the benefits, but spending on tech should help the bank make even more money later on.

JPMorgan Chase doesn't depend on just one way to make money. If loans slow down, they can make up for it with trading or managing assets.

If the market isn't doing great, they often rely on things like customer deposits to keep things steady. This mix of income sources has helped them stay profitable through good times and bad.

“JPMorgan Chase doesn’t bet on one market, it earns money across the entire financial system.”

Segment | Primary Income Source | Stability |

|---|---|---|

Consumer Banking | Interest & fees | High |

Investment Banking | Advisory & trading | Medium |

Asset & Wealth Mgmt | Management fees | Medium–High |

Commercial Banking | Business lending | Medium |

Mostly from loan interest, credit cards, investment banking, and managing assets.

It's both. They do regular banking plus investment and asset management all over the world.

Yep. Regular banking and deposits can make up for losses in investment banking or trading.

Interest rates have a big impact on their income, but they have many revenue streams which help protect them from being too dependent on one thing.

It's usually seen as one of the safest banks in the United States because it is so large, heavily regulated, and has different ways of making money.

JPMorgan Chase profits by serving a broad range of clients worldwide, from individuals to huge corporations. The company's income comes from banking, investments, and asset management. With diverse operations and ongoing tech investments, JPMorgan Chase maintains its leading role in global finance.