Console

Dec 17, 2025

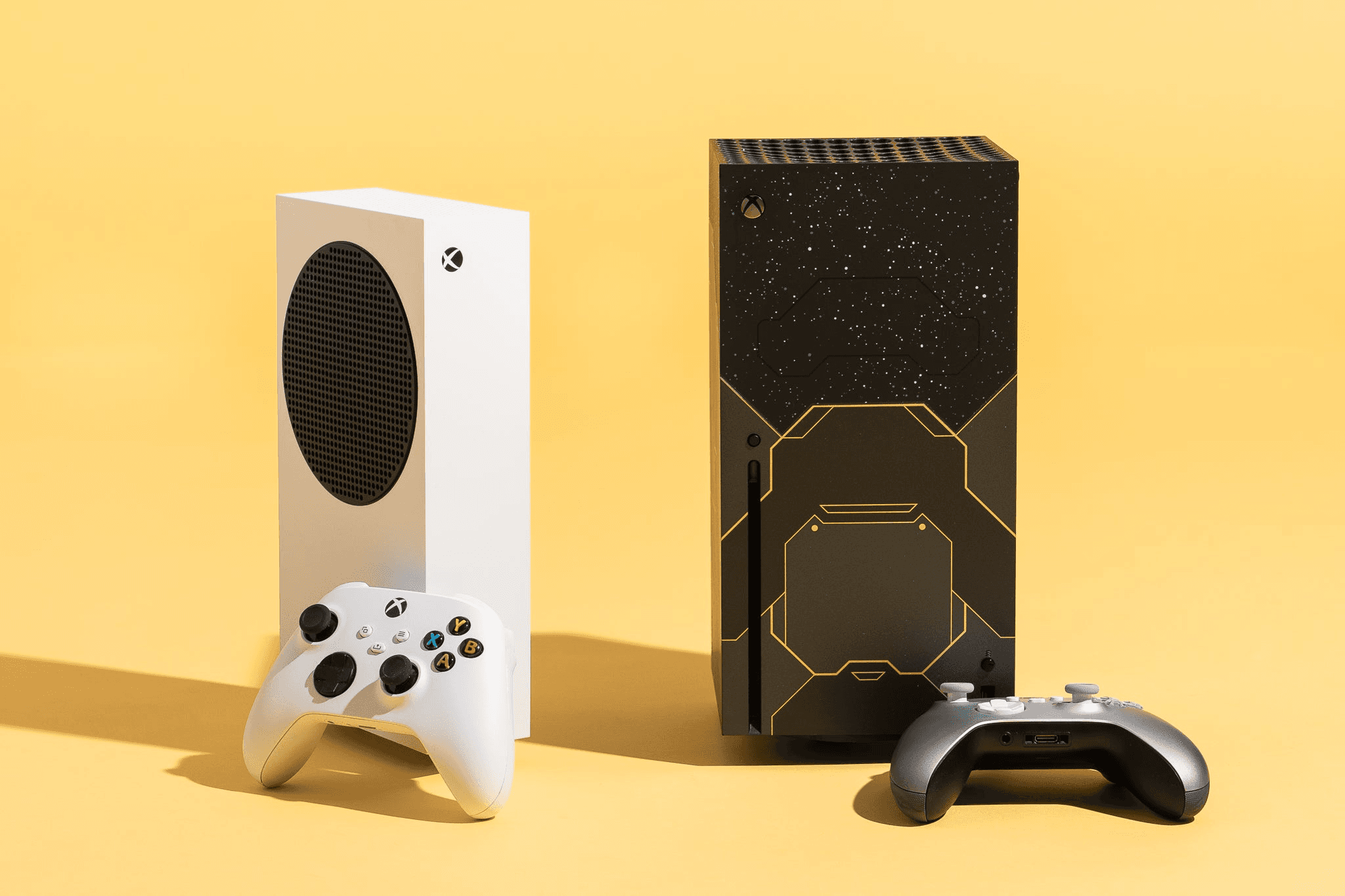

For the first time since 1995, U.S. video game hardware sales in November 2025 plunged, with units down sharply amid rising prices and economic pressures. Photo by:

November is normally the biggest month of the year for video game hardware in the United States. Black Friday deals, holiday buzz, and major game launches usually push console and PC hardware sales to some of the highest levels annually.

But not in 2025.

According to data from analytics firm Circana, U.S. hardware sales for video games in November 2025 fell 27% compared to last year, with total spending dropping from about $949 million in November 2024 to just $695 million this year.

This made it the lowest November hardware spending total since 2005, and the fewest units sold in November since 1995 when only 1.4 million units sold compared to about 1.6 million this year.

This steep drop surprised industry watchers and gamers alike because November normally sets the tone for holiday console sales and can often make or break the yearly totals for console makers like Sony, Nintendo, and Microsoft.

In past years, like 2024, November hardware sales were much stronger. For example, VGChartz estimated that in November 2024, the PlayStation 5 alone sold over 1 million units in the U.S., showing how much demand still existed before the 2025 collapse.

In contrast, November 2025 saw 1.6 million total hardware units sold across all major consoles the lowest level since the mid-1990s.

While the average selling price of consoles rose to $439 a record for a November month this suggests many consumers were priced out rather than encouraged to buy.

Higher prices reflect manufacturer increases due to tariffs, supply constraints, and inflationary pressures.

This year’s rank for consoles in dollar and unit sales saw Sony’s PS5 leading, followed by Nintendo Switch 2 and then the Xbox Series X|S, but even the winners couldn’t stop overall market contraction.

Many factors combined in 2025 to weaken hardware sales across video games, PCs, and broader tech markets:

As prices rise and real incomes stagnate, consumers often cut back on discretionary spending like consoles and gaming PCs.

Even though broader retail sales may be up slightly in some sectors, consumers are more careful with big ticket items and consoles cost hundreds of dollars at minimum.

Manufacturers like Sony, Nintendo, and Microsoft raised prices in 2025 due to increased production costs, tariffs, and global supply chain strains.

While this boosts revenue per unit, it also pushes potential buyers to delay or cancel purchases.

PlayStation 5 and Xbox Series X|S are now many years into their lifecycle, and without major next-generation hardware launches yet, many gamers are choosing to wait rather than upgrade.

Similarly, while Switch 2 had some initial momentum earlier in the year, it couldn’t carry the hardware market during November’s slump.

US PC shipments and sales have also been weak in 2025. Reports show PC shipments dipped in recent quarters as consumers delay upgrades or buy less expensive models.

A 1% annual drop in PC shipments was recorded in Q3 2025 amid broader tech sales pressures.

Many younger gamers today are comfortable skipping new hardware and finding ways around full-price purchases.

Digital game sales, subscription services, and even second-hand hardware markets can cannibalize new hardware demand over time.

A quick look back helps show how dramatic the change is:

Year | Approx. U.S. Hardware Units Sold in November |

|---|---|

1995 | ~1.4M (baseline reference) |

2024 | ~xxM (all major consoles strong) |

2025 | ~1.6M (lowest since 1995) |

Note: 2024 figures are estimated retrospectively from various data trackers, and the key comparison point is the significant drop from late-generation launches in previous years to this stagnation in 2025.

For gamers, especially those aged 14-25 in the U.S., these numbers reflect real economic priorities: when budgets tighten, big hardware purchases get postponed.

For the industry, this slowdown threatens the holiday season revenue and may push manufacturers to rethink pricing or accelerate next-gen console development.

Some communities online saw the writing on the wall. Long Reddit threads joked that “everyone is broke” and pointed out how steep game and hardware prices have become.

Hardware isn’t the only category suffering. Physical software (game discs and physical PC games) also hit one of its weakest Novembers in decades, suggesting the slump wasn’t isolated to consoles alone but reflected broader consumer caution.

Industry analysts expect tech and gaming markets to remain cautious in 2026.

Global PC shipments are expected to grow modestly overall, but consumer segments still lag behind commercial and enterprise buys, showing that most buying isn’t coming from casual users yet.

The hardware curve may rebound once next-generation consoles arrive or if major game exclusives give consumers strong reasons to upgrade.

November 2025 saw a ~27% drop in hardware sales due to higher prices, weak consumer spending, delayed upgrades, and broader economic pressures.

It’s the worst November since 1995 for unit sales and the lowest hardware spending in 20+ years.

Sony’s PS5 led unit and dollar sales, followed by Nintendo’s Switch 2 and then Xbox Series X|S.

Yes, PC shipments and hardware sales have also shown decline trends in 2025 amid broader tech industry headwinds.

Not necessarily, gaming software, digital sales, and subscription services still show growth in many areas, but traditional hardware purchases are lagging.