News

Dec 5, 2025

Learn how Saudi Arabia’s Public Investment Fund is set to own 93.4% of Electronic Arts (EA), what the $55 billion buyout means for gamers, and why this could change gaming forever. Simple, clear and easy to understand for all. Photo by: ABGN

Late 2025, EA, a giant name in video games, agreed to be bought in a massive deal. Public Investment Fund (PIF) of Saudi Arabia, along with Silver Lake and Affinity Partners, struck a deal valued at $55 billion to take EA private.

Once approved, PIF is expected to hold a 93.4 % share of EA. The remaining shares go to Silver Lake (about 5.5 %) and Affinity Partners (about 1.1 %).

This deal, if finalized, would mark one of the largest acquisitions in gaming history.

PIF isn’t new to gaming. Over the past years, it has made big investments in several game companies showing that Saudi Arabia wants to be a global gaming powerhouse.

Silver Lake is a well-known private equity firm. Affinity Partners tied to PIF in this deal also helps facilitate big investments. Together, they claim this takeover will let EA “accelerate innovation and growth” to shape the “future of entertainment.”

According to statements from PIF, the goal is to use EA’s global games to connect fans worldwide mixing entertainment, gaming, and possibly esports under a new global vision.

Because the buyout will be debt-backed (about $20 billion in loans), many analysts worry this could lead to cost-cutting moves inside EA in the future.

EA itself has a history of closing studios or cancelling games when profits don’t meet expectations. So there’s concern some studios even those working on beloved franchises could be scaled back.

On the other hand, some supporters argue that under new ownership, EA might get more global reach: more investments, more cross-region games, maybe stronger support for esports. PIF’s previous gaming investments suggest they aim for long-term growth, not just profit.

This is not just any business transaction it signals a broader shift in how the global capital intersects with gaming.

PIF’s majority ownership of EA gives a sovereign wealth fund tremendous influence over what types of games get made and how they are monetized.

That raises concerns about creative freedom, content direction, and long-term stability in game development.

Also, some critics point out that this deal happens at a time when PIF already has many big investments from cities and infrastructure to entertainment and gaming making this one of the boldest global bets on video games.

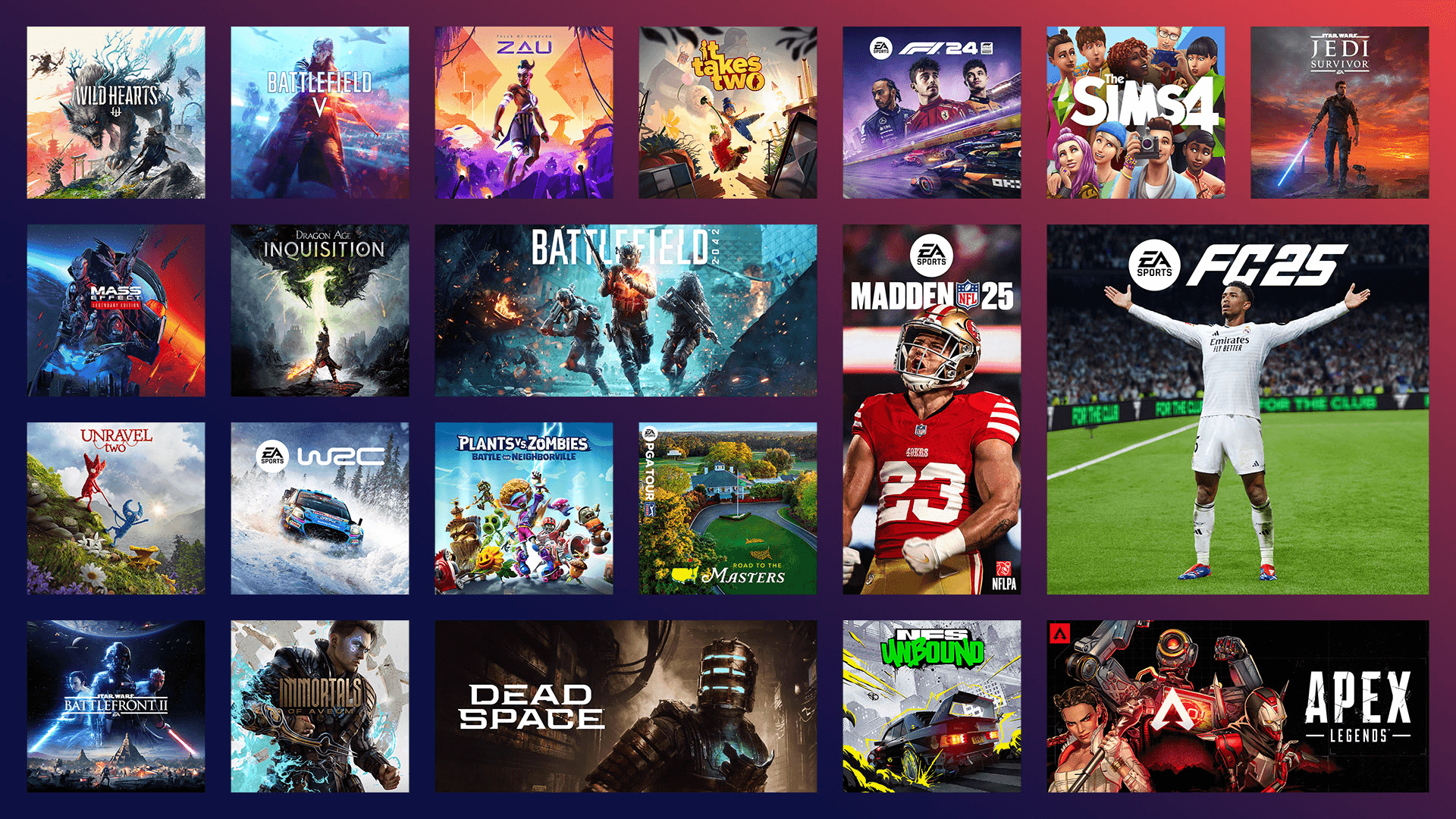

For many players around the world, especially fans of EA’s big franchises, this could mean not just new games but possibly changes in what those games look like, how they are sold, and who benefits from them.

The deal still needs to pass global regulatory approvals. Only then will EA officially become a privately owned by PIF & partners.

Meanwhile, players and the gaming community should keep an eye on: how the studios under EA respond, whether the game quality changes, how the monetization (in-game purchases, subscriptions, etc.) evolves and how transparent the new owners are about the creative direction.

It is also important to watch whether this encourages more big funds or countries to invest in gaming which could rebuild how video games are being developed and controlled worldwide.

This takeover of EA by PIF if completed could thus change the global gaming landscape forever. For better: we might see more investment, more growth, and higher global reach.

For worse: creativity and studio independence might get squeezed under the debt and global business strategy.

For gamers and fans, it’s a moment of watchfulness. Games may still arrive but what they look like, how they are made, and who decides could shift drastically. In short: this is more than a deal. It could be a turning point for video games worldwide.